How AI Transforms First Notice of Loss (FNOL) with Automation

Blog

AI in FNOL is revolutionizing the insurance sector by automating claim intake and validation, significantly reducing processing times and enhancing the insurance customer experience. This blog explores FNOL insurance meaning, challenges, AI-driven solutions, and future trends in intelligent claims management.

Redefining FNOL in the Age of AI

The First Notice of Loss (FNOL) is the critical first step in the insurance claims process, where a policyholder reports a loss event to their insurer. Traditionally, this stage faced delays and errors due to manual workflows. Today, Automated FNOL, powered by artificial intelligence, is transforming how insurers respond to incidents and settle claims.

What is the First Notice of Loss (FNOL) meaning?

FNOL refers to the initial report made to an insurance company after an event such as an accident, theft, or natural disaster. It is the pivotal moment that triggers the claims process. A streamlined Digital FNOL process increases accuracy and speed, ultimately improving customer satisfaction.

What is FNOL in insurance?

At its core, FNOL is the notification submitted to insurers concerning a claimable event. This process involves capturing all details of the event and verifying their authenticity to initiate further claim processing.

What does date of loss mean?

It is the exact date when the incident leading to an insurance claim occurred. The date of loss is crucial for validating coverage, determining liability, and ensuring prompt settlement. You might be wondering, what does date of loss mean on an insurance claim?” It determines whether a claim falls within the policy’s effective period, which directly affects claim eligibility and outcome.

What is date of loss in insurance?

This refers to the moment an insurable event happened, as reported during FNOL. Accurate capture of this date is vital for expedited claims handling and avoiding disputes.

Key Challenges in Traditional FNOL

- Data silos and unstructured inputs.

- Long claim initiation times.

- Human errors and inconsistencies.

- Poor customer communication.

- High operational costs.

Manual data entry, delayed updates, and fragmented systems often hinder the effectiveness of traditional FNOL reporting. These lead to slower settlements and dissatisfied customers.

How AI and Automation Transform FNOL

AI in FNOL introduces advanced technologies, such as natural language processing (NLP), optical character recognition (OCR), and machine learning in insurance claims, to automate and optimize the intake and validation of claims.

Intelligent Data Capture and Validation

- AI-powered systems use NLP to extract data from forms, images, or voice recordings.

- OCR scans and verifies documents instantly.

- Automated fraud detection flags suspicious submissions, preventing erroneous payouts.

Smart Triage and Routing

- Claims intake automation prioritizes and routes claims using ML algorithms.

- Reduced manual intervention results in faster assignments and lower error rates.

Personalized and Real-Time Communication

- AI chatbots assist policyholders 24/7.

- Automated updates via SMS/email enhance transparency and trust.

Predictive Analytics for Faster Decisions

- AI predicts claim complexity and settlement readiness.

- Data-driven workflows deliver rapid, accurate decisions.

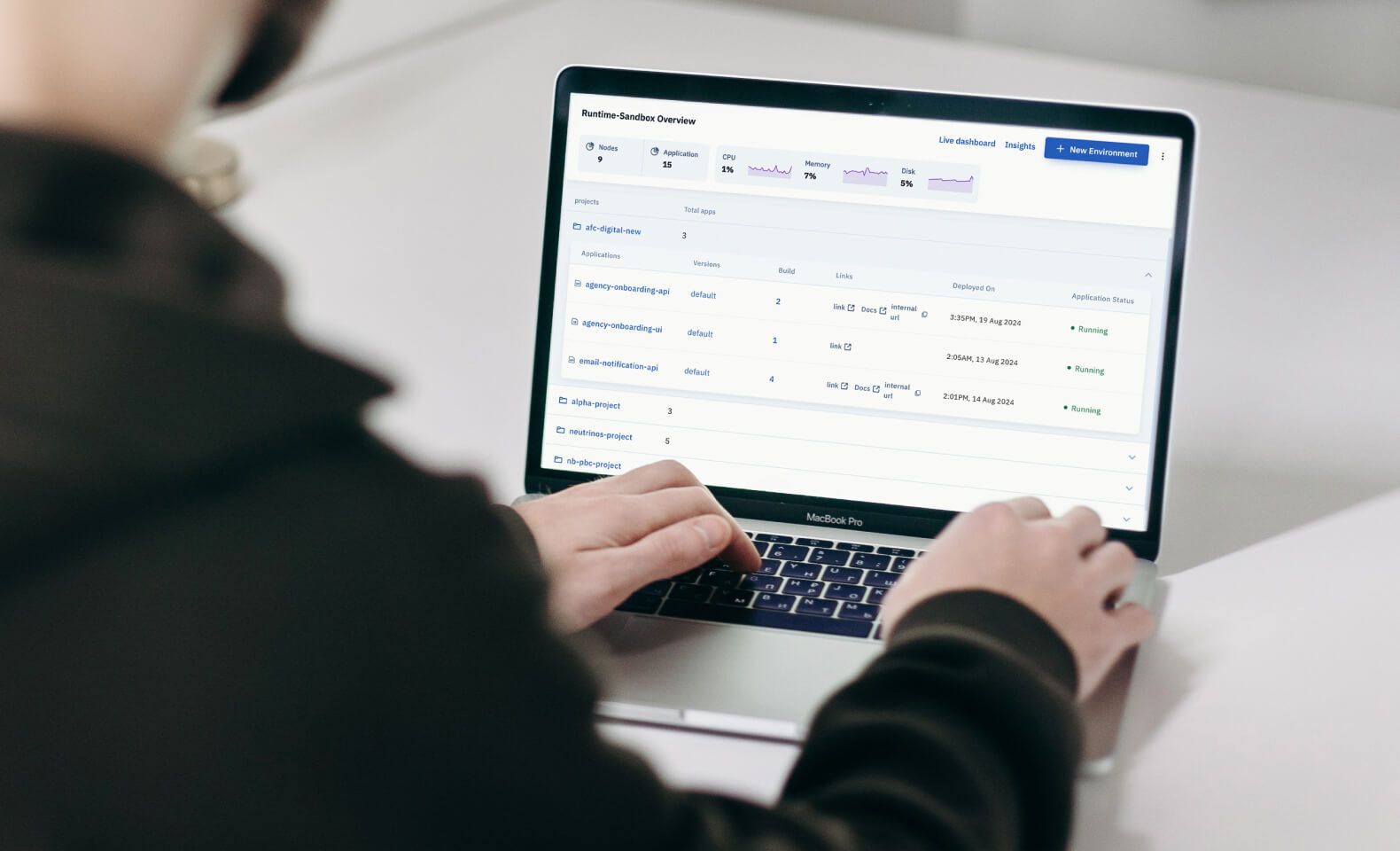

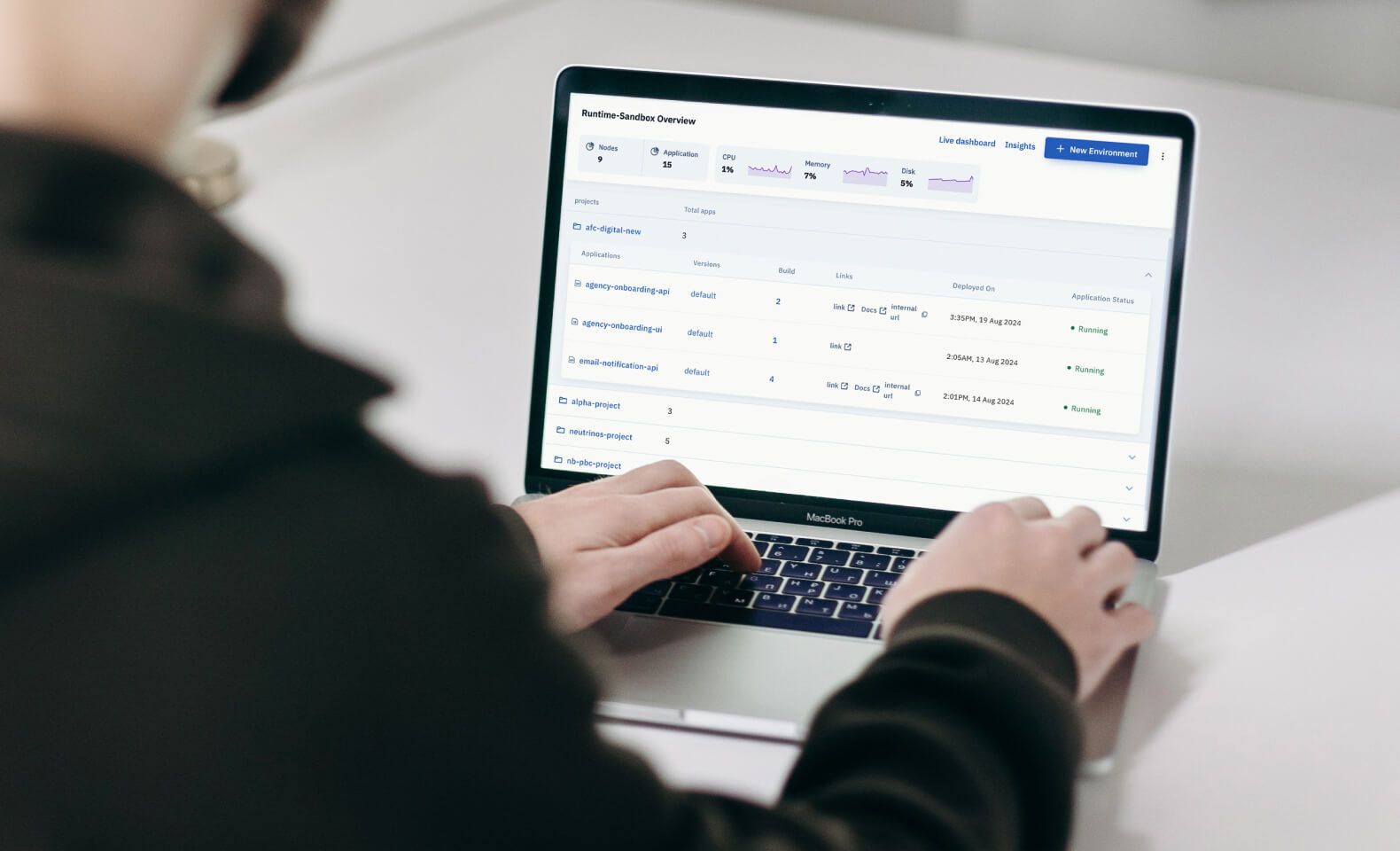

Seamless Integration Across Systems

- Orchestration across policy, CRM, and claims systems through APIs.

- Real-time data exchange improves service speed and accuracy.

Business Impact of AI-Driven FNOL

| Metric | Before AI Automation | After AI Automation |

| Average Claim Initiation Time | 2-3 days | Within minutes |

| Data Accuracy | 70%-80% | 95% |

| Operational Cost per Claim | High | Reduced by up to 40% |

| Customer Satisfaction (NPS) | Moderate | Significantly improved |

In one case, a leading insurer accelerated receipt of claim acknowledgement, reducing the time from over 4 hours to under 10 minutes.

Real-World Use Cases

- Mobile apps enabling AI-powered claims intake via photo/video uploads.

- Automated FNOL chatbots on insurance websites.

- AI-based triage for weather-related and auto claims.

Implementing AI for FNOL: Key Considerations

- Ensure data readiness and system integration.

- Choose the best automation or orchestration platforms.

- Compliance and data privacy.

- Balance automation with human review.

The Future of FNOL: From Reactive to Predictive

Advances in IoT, telematics, and image-based AI are set to make FNOL proactive. Insurers could soon predict and even prevent losses, using connected car alerts or weather sensors, which is a dramatic shift in intelligent claims management.

Conclusion

AI-powered insurance workflows and automated claim processing reshape FNOL for a new era, benefiting insurers and policyholders alike. Embracing these tools means faster settlements, reduced cost, and happier customers.