Power insurance AI with pre-built autonomous agents

Autonomous AI Agents that are built to solve insurance challenges across claims, underwriting, servicing, fraud, and more.

Enterprise-ready AI Agents, purpose-built for insurance

Delivered through the Neutrinos platform and AI Hub, the Neutrinos AI Agent Library offers a vast collection of pre-built, enterprise-grade, insurance-native agents that act on your behalf, automating tasks across claims, underwriting, servicing, and more. Mapped to high-impact, real-world use cases, these agents integrate seamlessly into existing systems - governed, explainable, and centrally managed through the Neutrinos Platform. Deploy agents at scale to accelerate automation, improve accuracy, and unlock measurable business outcomes without starting from scratch.

Go further with Neutrinos

Pre-built for insurance use cases

Each agent is designed for specific insurance scenarios like FNOL, fraud detection, quote generation, adjudication, and more; giving teams an actionable foundation that fits real-world workflows.

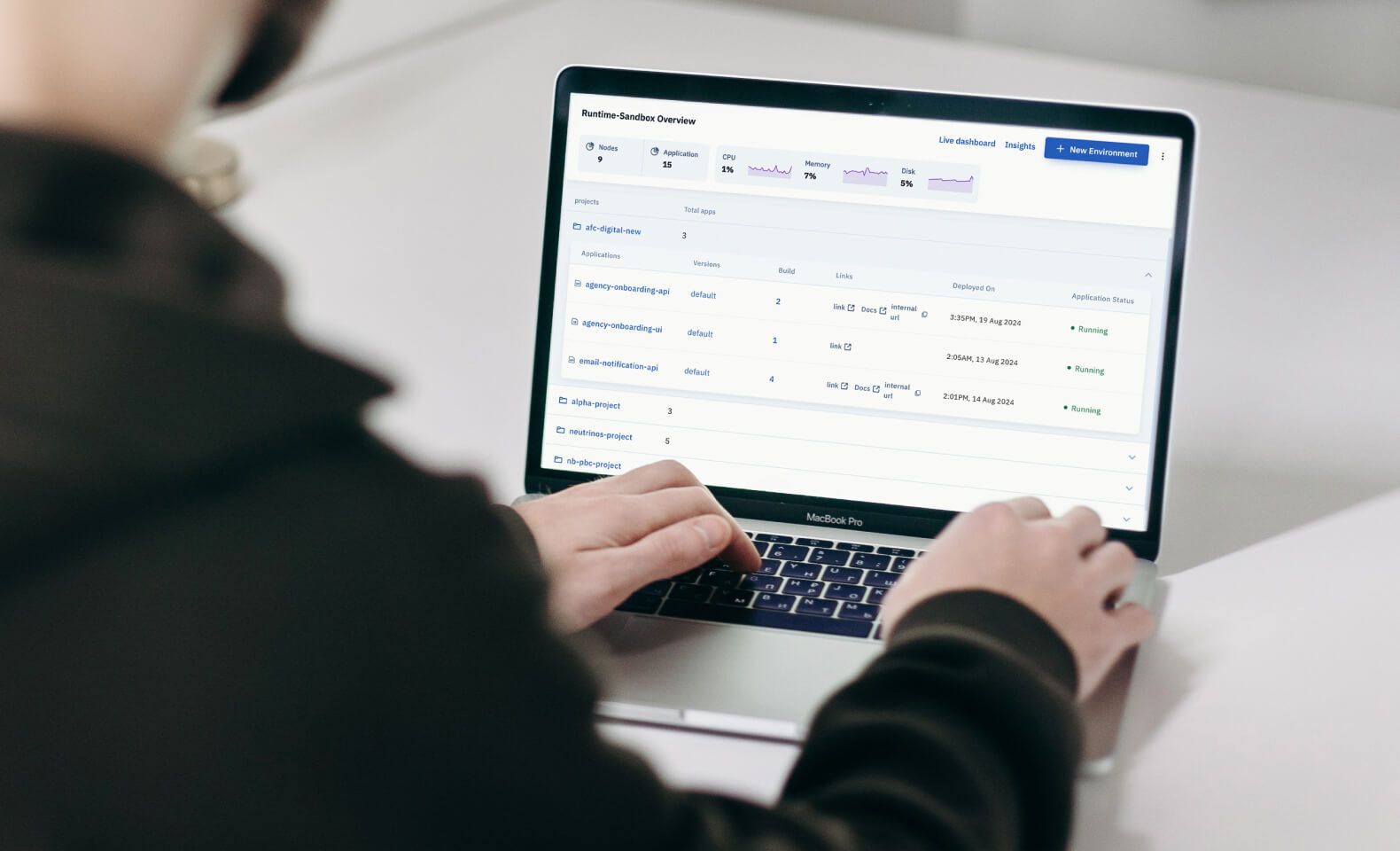

Accelerated time-to-value

Launch AI agents without long dev cycles or disruptive migrations. Deploy, monitor, and scale agents across systems with minimal IT lift and faster business impact.

Seamless system integration

Agents handshake with both legacy and modern platforms, orchestrating workflows without requiring major architectural changes or data migration.

Built-in governance & observability

Track every agent interaction with audit trails, alerts, and logs. Ensure compliance while maintaining full control and visibility into decision paths.

Improved efficiency & accuracy

Reduce human error, eliminate repetitive tasks, and enable straight-through processing with intelligent, autonomous insurance agents.

Empowered human + machine collaboration

Agents augment underwriters, claims handlers, and advisors; delivering context-aware insights or escalating when human judgment is needed.

Insurance-native AI Agents built for immediate impact

Neutrinos' pre-built agents deliver real-world automation across the insurance value chain, and they are governed, explainable, and ready to scale.

Fraud detection & adjudication support

Detect anomalies, validate evidence, and flag inconsistencies to reduce leakage and support accurate adjudication.

Medical & document intelligence

Extract, classify, and structure unstructured documents to improve accuracy, compliance, and straight-through processing.

Distribution support & compliance

Track documents, monitor conversations, and support advisors with personalized recommendations and audit readiness.

Underwriting & risk assessment

Simulate pricing, assess risk, and deliver real-time underwriting support for faster, more consistent decisions.

Claims automation

Automate FNOL, verification, triage, and reconciliation to accelerate processing and reduce manual effort.

Customer communication & engagement

Deliver real-time updates, contextual nudges, and onboarding support across the policyholder journey.